009

Strength of Demand vs. Strength of Brand

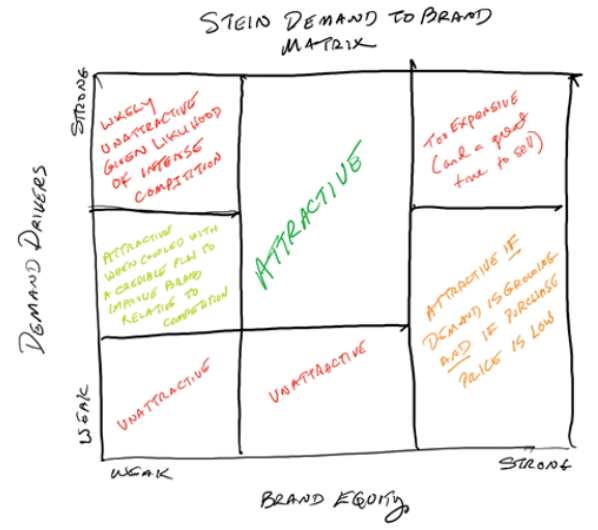

What is more important when looking at a deal: the strength of demand drivers, or the strength of the target company's brand equity?

With rare exception, Demand – not Choice (brand equity among suppliers) – is more fundamental to a successful acquisition outcome. Both obviously matter, but the balance and the relative performance can be a distinguishing source of a winning investment strategy. Without underlying demand drivers securely in place, few customers are going to waste their time or money considering a product or service – and frustratingly, demand can be fleeting. We have all experienced cases of demand and growth levels dropping post acquisition, and those are never the most fun deals. And you’re not going to win with many investments without strong or growing demand drivers.

My very favorite deals are ones with the following three-factor combination:

- Demand drivers are rock solid or growing; and

- The target company’s brand equity sits at the top end of the middle of the pack (but no greater); and

- The target company’s brand equity does not demonstrate any dramatic dominant negatives on any of the customers’ key choice factors.

Too many deals are valued high with the exact opposite mix, with too much enthusiasm centered on a leading player.

As a prospective owner whose charter is to not just ride a wave but to improve outcomes, would you rather rely on skills to rally demand or to shape choice? The presence of strong demand drivers makes everything else easier. And when brand equity is only moderate, opportunities to create value as an owner increase radically.

There are special cases where the target company has unusually strong market development skills, and it seems to know how to spin special magic and attach market development skill to brand preference (think GoPro and Apple). A premium can be very worthwhile in such cases – if the ceiling for demand is significant. Few firms are great at it, and these capabilities can really distinguish an investment when you find these select cases. Where investors get into trouble is when they mistake a minority segment for mass.

Diligencing demand requires solidly answering these five core questions:

-

Why do people buy (what is the nature of the underlying need being addressed)?

-

What triggers the purchase?

-

What triggers volume?

-

Are there any threatening genuine disrupters at play to any of the above three answers? Which demand drivers are waning, and which ones are waxing? And for which segments (the large and fast growing, or the smaller and slower growing)?

-

What is the relationship between current penetration of a solution relative to the total addressable market (size), and is there any chance that the segment(s) that have adopted more likely represent the full potential rather than the tip of the iceberg?

Given its fundamental character to the acquisition, get to these questions early in the diligence process and give this the very strongest rigor that you can. And most importantly, do not let anyone on the team mistake (or represent) a hypothesis for an untested or under-tested fact.

Copyright © GRAPH Strategy LLC