014

A Commercial Due Diligence Perspective on Buyer Power

Everyone will be familiar with the concept of “Buyer Power” as described in Michael Porter’s famous framework. Indeed, almost all commercial due diligence exercises include some examination of TargetCo’s customers’ purchasing power – more specifically, the customers’ ability to apply pressure to lower prices or drive improvements in product (and service) quality, features and performance.

Equally important as an indicator of likely demand levels and purchasing dynamics – and sometimes missed in diligence – is the power and scope of responsibilities that the individual buyer has within her own company.

Even within the smallest and most specialised of companies, decision making can be complex.

- Few individual buyers have total power to make decisions in isolation. They are generally limited by budget parameters and certain economic incentives, and often have to consult with multiple other stakeholders to win consensus, gain permission, and drive to conclusion

- The products (or services) that TargetCo provides are probably just one of many different spend categories for which our buyers have responsibility – and those other categories may be of more or less importance

In today’s ultra-compressed deal timeframes, it’s understandably tempting (and many times necessary) to take short cuts to get diligence completed within the too few available days. Gaining a detailed understanding of the customers' workflow might seem like a lower priority issue than just nailing down quantitative measures like NPS.

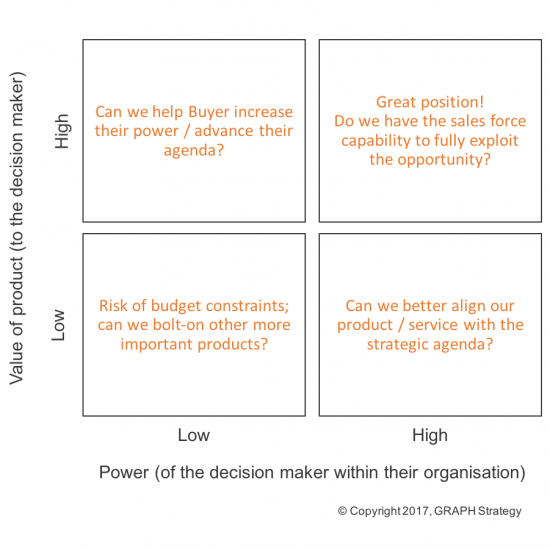

To help quickly get a handle on these issues, we like to place TargetCo’s business on a simple matrix- the Power/Value grid.

Understanding the current position of the TargetCo on the Power/Value Grid can help inform the go/no-go decision and valuation. In addition, understanding how things are changing (and what we can do to drive change) can make you a more effective owner of the asset and can inform value gen. strategies which other potential buyers might have missed. For example:

- What can we do to shorten the current sales cycle and increase turnover/order throughput?

- What type of selling skills does the business need and can we grow the business by expanding the size and skill base of the sales force?

- What is the true opportunity for bundling and cross-selling – what else is our customer buying, and can we provide it for them?

- What is the likely resilience of spend in the event of cut backs – which other categories are we competing with for our share of budget?

- How can we re-position our value prop so as to better align with customer priorities?

- How is the perceived value of our product changing over time, and what can we do to pre-empt and mitigate any negative trends?

- Can we find ways to equip our buyers to overcome roadblocks from colleagues (for example, by presenting a clearer financial business case)?

We hope that you find the grid helpful in stimulating thoughts on finding new value opportunities in your next deal. Happy deal making!

Copyright © GRAPH Strategy LLC